2020 has been a crazy year for everyone and just as much so with cryptocurrencies. Bitcoin was recently getting all the media attention after reaching a new all time highs for the first time since 2017. So we take a review and recap of the most important cryptocurrency, Bitcoin and Ethereum news in 2020!

Bitcoin smashes old ATH!

We have all been longing for it and now, finally, it has happened. After first resistance around previous 2017’s top, Bitcoin has finally found enough strength to establish new all time highs of over USD$26,000!!!

For the first time in three years all $BTC holders are now in profit, with new millionaires popping up at fast pace. Moreover, if we were to have a look at the best performing assets over the last 10 years, it would immediately be noticed as Bitcoin outperformed any other assets 8 times out of 10, with a stunning cumulative return in the order of magnitude of millions!

This is not a surprise for all crypto enthusiasts who have been accumulating for several months while prices were below USD$10,000 and are now ready to ride the roller-coaster towards new unexplored territory!

But with any hype, there are also traps! Here’s ONE THING you should avoid in crypto.

Publicly traded companies and institutional investors keep increasing their cryptocurrency exposure

2020 can be regarded as the year institutional investors came another step forward in publicly confirming their interest in crypto. While their cryptocurrency investments still usually amount to a small percentage of their portfolios, this is a clear signal that investors consider Bitcoin as a reserve currency to hedge against traditional fiat money and as an undeniable opportunity to diversify their overall exposure. These finance giants are smart investors, so they are certainly ones to watch.

At this very moment, the Grayscale Bitcoin Trust (GBTC) is setting the pace in the ranking of Bitcoin adoption with a stunning 2.60% of the total existing supply of Bitcoin.

Nevertheless, the company that has been most public about its crypto accumulation plan in the last months is certainly Microstrategy. Its CEO Michael Saylor has repeatedly tweeted news keeping his investors up to date. With more than USD$400 million worth bought solely during last summer, the company now owns more than 40000 Bitcoins in their portfolio.

Not only public investors are opening up to crypto. Recently Paypal has introduced crypto payments within their app. Users can now instantly convert their fiat assets to buy and sell items with cryptocurrencies. Although they don’t actually give ownership of the underlying coins (they can only be used inside Paypal) and cannot be transferred to other wallets, we are sure this is still the beginning phase of crypto adoption by traditional finance platforms.

Check out our full coverage of this in the 17th edition of our newsletter as news of big $BTC buys were announced!

Ethereum 2.0 ETH2 finally launched

The long wait has been rewarded and Ethereum 2 (in its Phase 0), is now a reality!

On 1st December 2020 and as planned, the mainnet was successfully launched on the first attempt. There were initially concerns that the required threshold to automatically trigger the launch could have not been achieved by the deadline. However the amount of Ethereum staked in the deposit contract suddenly surged in the final days leading up to the deadline, confirming that the hype around the launch was real and that there were enough supporters willing to lock their tokens for months (or possibly even years)!

One of Ethereum 2.0’s key features is known as “Sharding”. It will enable the simultaneous processing of transactions which will significantly improve the current speed of the network, something that has recently created not a few struggles to its users.

Check out our article on what is Ethereum 2.0 and what we can expect. We also have a video on 5 things you must know about Ethereum 2.0.

Everything is Decentralised Finance!

2020 has no doubt been the year of decentralised finance (DeFi). And while serious cryptocurrency enthusiasts were already quite familiar with it, in 2020 its adoption just went mainstream. It wouldn’t be much wrong saying that this year everything in crypto has revolved around decentralised finance!

What is DeFi?

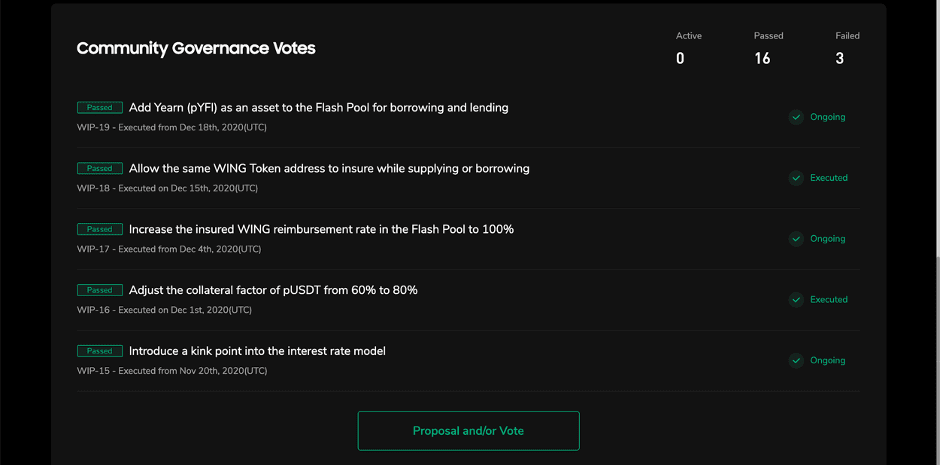

It could substantially be defined as an experimental form of finance with, as pivotal point, the absence of any form of intermediaries. This means banks, brokers and any other middle men are cut off because blockchain doesn’t need them to work. Everything is ruled by smart contracts, hence everything is decentralized. Not all the projects are 100% decentralized yet, but the way to achieve it has been paved.

DeFi has all kinds of platforms: lending, borrowing, coverages, prediction markets, trading, synthetics and so on.

Since smart contracts are needed, the blockchain most protocols are built on is Ethereum. Despite its weaknesses (scalability), it continues to be the steady central point of the DeFi “movement”. Other chains are growing fast behind it, in particular Binance Smart Chain (BSC), while other are trying to increase their adoption too, such as Polkadot (with the use of parachains), Ontology and more. Cross-chain platforms like Ramp are also hot: connecting different chains is another step forward in helping decentralized finance’s growth.

Check out our Decentralised Finance article list and YouTube DeFi playlist.

(Yield) farming became a totally legit profession

Within Defi, certainly Yield Farming was THE thing on everybody’s lips.

During what can be referred to as the “Defi Season” last summer, the bravest users were getting incredible Annual Percentage Yields (APY).

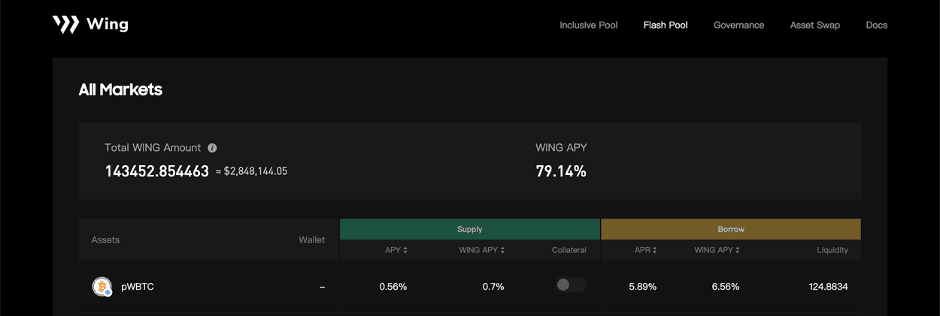

It all started in July 2020, with Compound Finance and Yearn Finance (which made Andre Cronje even more known) as main actors when they decided to distribute their governance tokens $COMP and $YFI to their platforms’ users. Governance tokens, supposedly worthless, started to gain more and more value representing the “strength” of the underlying project. The higher their value the bigger the APYs users could get. New strategies arose, where “farmers” would “fold” or leverage their returns by supplying and borrowing multiple times. This is possible using the borrowed assets each time as new collateral for the next loan. At that point, the Yield Farming “mania” was already out of hand and any upcoming project would offer the option to farm their proprietary tokens.

But as usual, with high rewards come high risks. The main ones farmers have to face are platforms’ exploits and Impermanent Loss, which can very often lead to permanent losses! See our video on what is impermanent loss and how to avoid it.

Calling someone a crypto “degenerate” is no longer an insult

With the rise of yield farming and DeFi, a new specialty has also arisen. People manage to find projects just before or very soon after they are listed on Uniswap, and throw everything they have into it. Short for “degenerate gamblers”, these people that “ape” into projects (without much thought into exactly what it is or what it does) try to catch the initial wave and accumulate as much of these tokens as possible before others do, and then sell when the project becomes more widely known and demand increases.

Whilst this is highly risky not just in terms of return on investment, there is also a risk of being “rug pulled”. So as with all gambling, some win big, but some also lose.

“Rug pulls” hurt our wallets and our appetite for DeFi

As much as 2020 has been about Defi, it has also been the year of “Rug Pulls”.

We have witnessed countless episodes of stolen funds in the last months, and the trend doesn’t seem to be going to stop anytime soon. Hackers are evolving with smart contracts and are getting more sophisticated each time.

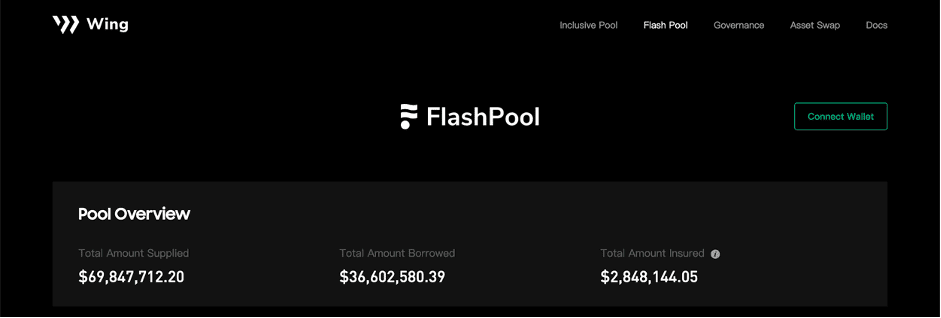

Flash Loans have been the favorite way to deliver an exploit till now. Basically a flash loan is something “non malicious” per se. What it implies is that any user could theoretically take out a loan (without providing any collateral). The only condition is to pay it back within the same transaction. But before this last step, the user can do whatever he prefers with the borrowed funds. For example, try to make money out of it! In this case, he would end up profiting off this flashloan! Magic? No, just Ethereum (and Smart Contracts!).

This mechanism is possible because the blockchain itself doesn’t even have “time” to realize what is going on. As a matter of fact, if the loan is not paid back in time, the transaction is simply rejected.

All of this is of course easier said than done, and it is not something within just anyone’s reach: this is the way the most sophisticated arbitrages are done. Unfortunately, this is also the way sophisticated hackers profited off some Defi platforms’ vulnerabilities.

Examples of flashloan attacks have been the ones at the expenses of bZx (three times for a total of around $9M), Value Defi ($7.4M), Harvest Finance ($24M), Akro ($2M) and Origin Protocol ($7M), plus many other less known projects.

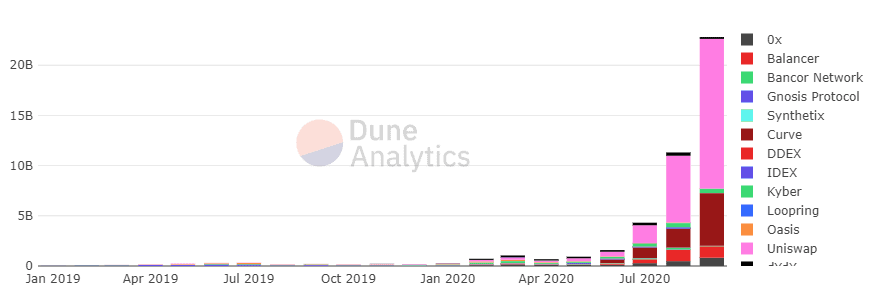

DEX- the new challenger in town

This year has seen lots of drama among centralised exchanges (CEX) but they also were met with a serious challenger, the decentralised exchange (DEX). Decentralised exchanges promised self-custody of funds (i.e. less risk of hacks) and opened up a whole new world of “crypto dumpster diving”.

As Defi was exponentially growing in 2020, so was the use of DEXs. Decentralized Exchanges like Uniswap and Sushiswap mainly rely on the AMM (Automatic Market Making) system to provide traders with the necessary liquidity to operate. Funds are pooled together and an algorithm is in charge of controlling the price curve.

Unfortunately this system is not flawless, and problems such as high slippage are still real in most cases. A key difference with centralized exchanges is the non-existence of order books. This is mainly because Ethereum doesn’t really have the necessary capacity to handle it. There are platforms that allow limit orders (1Inch Exchange for example) but there still is work to do. This is the reason why we also see exchanges being built on other chains such as Project Serum. This DEX offers a CEX-simil experience on the Solana blockchain (able to handle far more transactions per second than Ethereum).

NFTs: bringing art collecting into the digital age

Non Fungible Tokens (NFTs) are another crypto segment that has seen increasing adoption throughout 2020, and many believe 2021 will mark its explosion. They became first popular in 2017 with CryptoKitties but now the market seems to be more mature to just not consider them as a “meme”.

Non Fungible Tokens are unique non-interchangeable tokens (usually compliant with the ECR-721 standard) and can have many different uses other than just collectible items. They can be used in games (think of the Enjin multiverse); players can build or just enhance their NFTs to make them more valuable and exchange them with other gamers. They can and are introducing Art into the crypto ecosystem. Artists can create their digital pieces of Art and sell them on the blockchain on the available markets. The most known are Rarible and Opensea, where users swap NFTs in a similar way to exchanging standard ERC-20 tokens. Some of the most expensive NFTs have been auctioned for hundreds of thousands of dollars.

They are also strictly related to the “tokenization” concept. Everything in the real world can theoretically be tokenized into a NFT and transferred on the blockchain. Think about real-estate. You could digitize your house and use it to ask for a loan against its value, or you could sell/lend your piece of land and manage it with the security granted by the blockchain!

Are Regulators coming after crypto?

While crypto adoption keeps increasing worldwide, Regulators from any country are slowly but steadily turning their interest to crypto. They want to keep track of how things are evolving and decide how to approach the matter. It’s no surprise that Institutions have been struggling just to decide whether it was the case to tax crypto earnings and how to do it. Most countries still don’t have a clear legislation about it and crypto adopters are often left wondering what they should do to avoid future problems.

In 2020 we have seen many legislation proposals with the purpose of filling up gaps in regulations that would otherwise leave Institutions too far behind on the subject. Something they can’t afford to do.

Only considering the first half of December, we saw the Stablecoin Tethering and Bank Licensing Enforcement (Stable) Act and read of rumors about FinCEN (Financial Crimes Enforcement Network) proposed requirements regarding the use of self-hosted wallets (like Metamask). While it is certainly true that a tiny minority of crypto users take advantage of the (partial) anonymity granted by the blockchain, the vast majority doesn’t have anything to hide and is worried about their privacy being exposed if all the regulations should find final approval. In November, Hong Kong has proposed strict regulations against cryptocurrency exchanges and even who can trade with them as well.

Meanwhile, we have witnessed examples of crypto companies seeking regulation and compliance with the law. In September, Kraken was granted approval to become “the first regulated, U.S. bank to provide comprehensive deposit-taking, custody and fiduciary services for digital assets”. A few days ago Coinbase officially confirmed that they have finalized their Initial Public Offering (IPO) request, now under the SEC (U.S. Securities and Exchange Commission) review process.

Digital currency race heats up

Digital currencies continue to be on top of many countries’ “To-Do list” when talking crypto and new payments technologies.

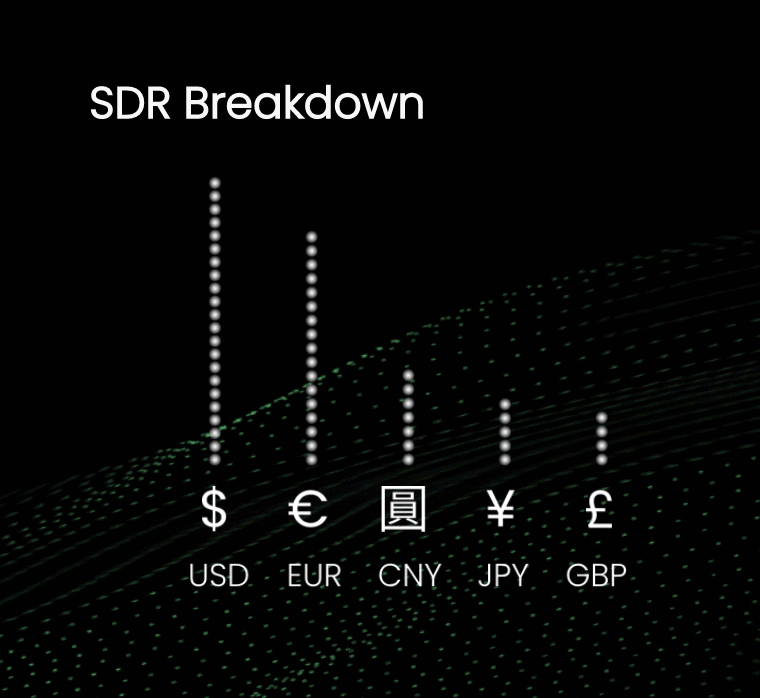

A digital currency directly issued by a State is something different from the current electronic versions of fiat money and would have the advantage of connecting Central Banks with final users in a more streamline way than now. Operations would be faster and cheaper. In Europe, for example, everything would be governed by the Central Bank itself. Christine Lagarde, president of the European Central Bank, is actively campaigning for the digital Euro, as shown in multiple occasions, and the work is proceeding.

While it is still not clear how the blockchain and the ledger will be structured, it is important that privacy remains at the center of the dispute, many believe.

In China, the DCEP (Digital Currency Electronic Payment, DC/EP) issued its state bank the People’s Bank of China (PBoC) is already in its testing phase, and ordinary citizens chosen for the testing were already people able to use it at designated shops and online retailers. We explain everything you need to know on DCEP.

Institutions are not the only entities working on digital currencies. $DIEM, the recently repackaged decentralized stablecoin powered by the Libra blockchain, should launch in January after years of tormented life!

Conclusion

2020 has been an eventful year for cryptocurrencies. However the technology itself is taking huge strides and challenging the way we see traditional finance (e.g. DeFi) and how we even view the currency we use on a daily basis.

Certainly what is most exciting of all is Bitcoin and Ethereum prices reaching all time highs. It is definitely making people confirmed in their beliefs that the winter is finally over, and the bulls are ready to come out.

With all these developments and positive price action, we think things can only get better. We are definitely excited to see what 2021 will bring!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.