What is Derivatives Trading?

A derivative is a contract based on an underlying financial asset such as a stock, bond, or currency. The value of the underlying asset is subject to changes according to market conditions.

Traders can use derivatives to earn profits by speculating future price movements of the underlying asset, a strategy becoming increasingly popular among cryptocurrency traders.

Why the Need for Risk Management?

The cryptocurrency market is volatile and speculative.

Everyone will take losses, including the most experienced professional traders. That is the name of the game.

Without risk management, a trader could deplete their budget and the game is over. The most important goal is to stay in the game. By analyzing platforms like Online Casinos Schweiz, traders can gain insights into managing their funds wisely. As long as the trader is still playing, they can make up for losses.

For that reason, it’s important to know when to take losses, how to manage risk, and generally aim to make more good trades than bad ones.

Important Things to Consider Before Trading

First, a trader should determine their total budget.

It does not matter if it is $100 or $100,000,000. The essential point is to have a given budget freely available. Traders should not use loaned money, which has to be paid back at a deadline. Using retirement money is not encouraged either.

A trader’s budget should be considered as “play money”. If a trader is emotionally attached to that money, these emotions can affect their trading decisions. A trader should aim to be a calm and collected statistician, not a passionate and desperate gambler.

Once a budget has been allocated, the next step is to look for a trade. There are tools available to find trades such as fundamental, sentiment, and technical analysis. But before entering a trade, a trader should determine the risk size, entry price, and stop loss.

The general rule of thumb for new traders is to risk at most 1% of the budget per trade.

The entry price might be the current market price or the limit set for an order.

Finally, it is essential to decide a stop loss before one enters a trade. How can a trader pick a stop loss? Technical analysis is the only available method, apart from randomly picking something. A trader can look at support and resistance levels, or trendlines.

These are the four ingredients for risk management: Budget, risk size, entry price, and stop loss. Having these ingredients will make it easier to manage risks when trading.

Transaction or Trade Volume

The volume of a transaction or trade is also known as “position size”. The position size is defined in relation to a trader’s risk tolerance and the size of their budget.

What are some risk management formulas that traders can use to determine their position size?

Here is one example:

Position Size = (Risk x Budget) / (Entry Price – Stop Loss)

Let’s say the trader has a budget of $10,000 and wants to buy Bitcoin for $30,000 with a stop loss at $29,500 and a risk of 1%.

Their position size would be (1% x $10,000) / ($30,000 – $29,500) = $100 / $500 = 0.2. They can buy 0.2 Bitcoin for this trade to stay within their risk tolerance and budget.

Some consider it advisable to make this calculation before every single trade. It can be tempting to take larger risks. (Zolpidem) However, this can be a recipe for disaster given the volatile crypto markets.

It’s always safer to stick to the math and be the calm statistician.

A trader can make a spreadsheet, where they can enter the parameters and it computes the position size or risk for them. This way it only takes a few seconds per trade and a trader can easily manage risks with every trade.

Stop Loss Orders

Stop loss (or just “stop”) is an order that traders can set to automatically close losing trades. It is the primary tool for risk management because traders can manage trades effectively during abrupt and unexpected market changes.

For instance, if there was some reported hacking, it could prompt a large price movement for the asset. If a trader has open trades and they happen to be in the opposite direction of the market movement, then they could be in danger of losing all their invested funds. A stop loss to sell will automatically prevent that from happening, which is why traders should always place a sell stop to avoid considerable losses.

Traders can also use a buy stop to buy when a target price is hit. A buy stop can be useful for automatically buying into target entry points.

Stick to the Trading Strategy

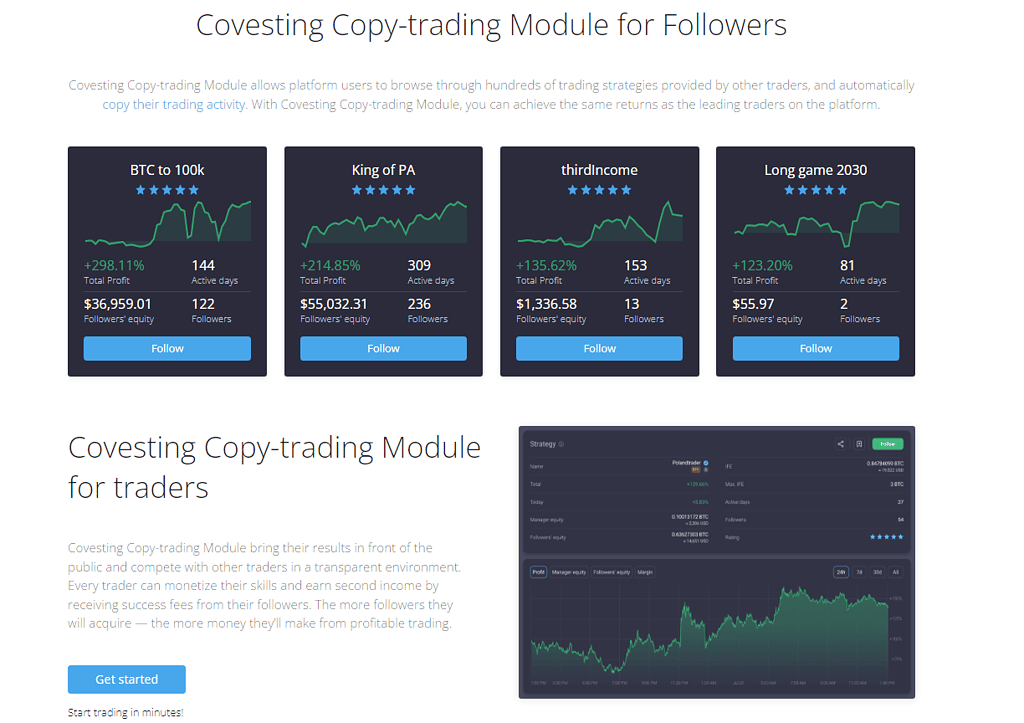

A trading strategy is only effective when a trader sticks with it, in sickness and in wealth.

Trading is a matter of getting the law of averages to work in one’s favour, so maintaining discipline is vital for consistent and profitable trading.

That being said, a trader’s strategy should be developed to fit their own goals, risk tolerance, and lifestyle. It should be based on reality, not on hope.

If a trader tries to copy someone else’s trading strategy without truly understanding it, chances are they will be incompatible with the strategy and will have trouble following it.

At the end of the day, each trader is accountable for their own trade decisions and therefore must be cautious when deciding on a trading strategy and seeking market opportunities.

Avoid Emotional Trading

There are two main emotions that will try to sway a trader from their strategy: fear and greed. These emotions are the culprits behind FOMO.

FOMO – the fear of missing out – is when a trader is afraid of missing out on a huge trading opportunity in the market. When FOMO happens, traders are susceptible to abandoning their strategy to chase the trading opportunity.

Greed can cause a trader to buy when prices are high because they are afraid of missing out on future gains, and fear can cause a trader to sell when prices are low because they are afraid of losing too much.

Fear and greed are amplified when a trading decision is based on hype rather than research and calculated strategy.

Understanding one’s emotions and keeping them under control will help traders avoid taking uncalculated risks caused by FOMO, and other emotional trading mistakes such as revenge trading.

Revenge trading happens when a trader tries to force a trade to recover from a loss. It’s driven by anger suffered from the loss and lust to make it all back quickly. This type of trading can easily cause a trader to invest more than they can afford to lose.

When a trader is overexposed in an asset, they aren’t trading or investing, they are gambling. When one gambles in general, things start going wrong, both logistically and psychologically.

Final Words: Risk, Reward, and Statistics

General wisdom says that it is best to invest and trade using small amounts of the total capital set aside for cryptocurrency.

That wisdom is rooted in two general concepts:

1. Risk / Reward

2. Statistics

Statistically, the larger the bid size, the more potential risk / potential reward per position.

Reward is nice, but to ensure rewards over time it is vital to limit risk.

The reality is that the risk of large bid sizes (relative to the total budget) outweigh the potential rewards statistically, over time, on average.

Consider a budget of $100. Now consider using that entire budget and losing 50% twice in a row, as opposed to using half the budget and doubling it twice. One leaves you with $25 and the other gets you to $225.

If $100 turns into $25, getting back to $100 will be a real challenge.

But if 5% of $100 is risked, that’s a total of $5. Even if lost, getting back to $100 from $95 is much easier. Sure, it will take more time to get to $225 using smaller bets, but statistically there will be many more opportunities to make gains and avoid losses.

There will be more room for skill, and less reliance on luck. Remember that anyone can get lucky, but luck can and usually will run out. Statistics are usually a safer bet.

Sources:

https://phemex.com/blogs/risk-management-in-cryptocurrency-derivatives-trading

https://www.coininsider.com/risk-management-in-crypto-trading/

https://learn.bybit.com/trading/crypto-trading-risk-management/

https://www.axi.com/int/blog/education/5-effective-ways-to-fight-revenge-trading#:~:text=Step%20back%20temporarily&text=Take%20a%20day%20off%20or,consider%20revising%20your%20trading%20plan

https://cryptocurrencyfacts.com/the-basics-of-risk-management-and-position-sizing-in-cryptocurrency

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.