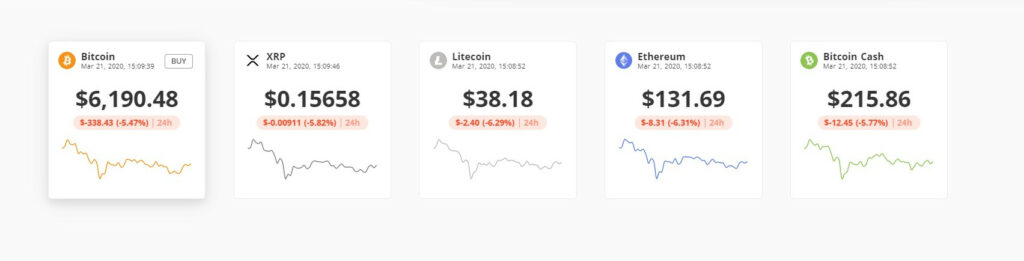

Bitstamp is a Luxembourg-based cryptocurrency exchange that offers users a secure platform to trade Bitcoin (BTC), XRP, Ether (ETH), Litecoin (LTC), and Bitcoin Cash (BCH) against fiat currencies (USD, EUR, GBP) and deposit/withdraw fiat currencies using credit/debit cards. In this Bitstamp review, we’re going to share how Bitstamp works, its fees, who it works best for and whether or not it’s safe. What is more, you’ll know if Bitstamp is the right exchange for you.

Sign up here to get started.

What is BitStamp?

Bitstamp is one of the oldest and most trusted cryptocurrency exchanges in operation. It is registered in Luxembourg and headquartered in the UK, and caters to both beginner and experienced traders. Customers can exchange bitcoin (BTC), XRP, ether (ETH), litecoin (LTC), and bitcoin cash (BCH) with each other and against fiat currencies (USD, EUR, GBP). They can also deposit and withdraw fiat currencies using their credit and debit cards. The trading and currency dashboards are clearly laid out and easy to use, making it a great choice for both novice and experienced traders.

Bitstamp was founded in 2011 as a European alternative to Mt.Gox. Bitstamp offers a secure and accessible middle ground between advanced trading and trading for beginners. With its user-friendly interface, advanced security measures, and a variety of trade types, it is a great choice for both experienced traders and those just starting out in the world of cryptocurrency.

Bitstamp offers users the ability to deposit and withdraw funds using their credit and debit cards, although this is usually more expensive than using a bank transfer. It has a solid security record, although it was subject to two cyberattacks in 2014 and 2015. Since then, it has managed to operate without incident and has been fully regulated by the Luxembourg government in 2016, making it a reliable and secure platform for users.

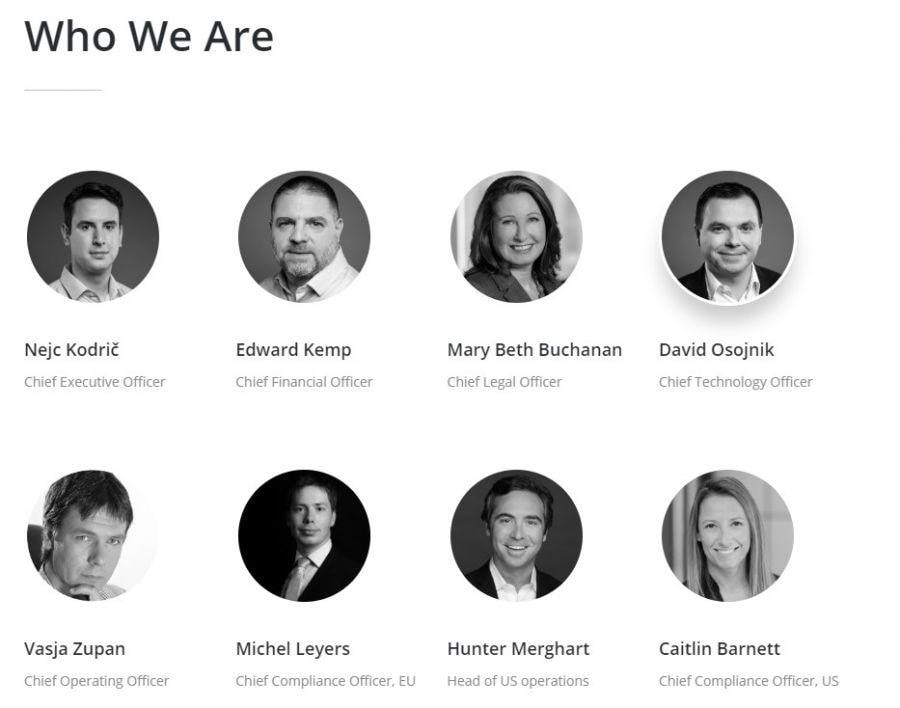

The BitStamp Team

The exchange company is led by CEO Nejc Kodric, with CTO David Osojnik, CFO Edward Kemp, and COO Vasja Zupan as key team members. Bitstamp offers a secure and reliable platform for customers to buy and sell digital assets, with a focus on providing a safe and secure trading environment. The company is committed to providing customers with the best customer service and support, and is constantly innovating to ensure customers have the best experience possible.

Key Features of BitStamp

BitStamp key features include:

Trusted Crypto Exchange for Global Traders: Bitstamp is a leading cryptocurrency exchange that offers traders from around the world a secure and reliable platform to buy and sell digital assets. With high liquidity and a fiat-to-crypto gateway, It is one of the most trusted and established exchanges in the industry.

Regulated Exchange: Bitstamp is the world’s first fully-licensed European cryptocurrency exchange, regulated by the Luxembourg Financial Industry Supervisory Commission (CSSF). It is a secure and reliable platform for trading digital currencies, offering users a safe and compliant way to buy and sell cryptocurrencies.

Buy cryptocurrencies with a bank card: Bitstamp offers a convenient way to purchase Bitcoin and other cryptocurrencies with a bank card. Customers can instantly buy digital currencies with their bank cards, making it easy to get started with cryptocurrency trading.

Low SEPA transfer fees: For Europeans, SEPA transfers are a low-cost way to deposit and withdraw cash directly to and from their bank accounts. SEPA transfers are more affordable than wire transfers, making them a great option for those looking to buy or sell cryptocurrency.

Mobile Application: Bistamp’s mobile app allows users to trade cryptocurrencies on the go, with support for both Android and iOS devices.

Perfect for Beginners: Bitstamp is a user-friendly cryptocurrency exchange that offers both beginner-friendly and advanced trading interfaces, making it easy for anyone to buy and sell digital currencies.

In summary, Bitstamp is a secure and reliable cryptocurrency exchange, offering a wide range of trading options for both novice and experienced traders. With over 9 years of experience, Bitstamp has proven its security and high liquidity, making it a great choice for those looking to buy and sell digital assets.

Key Advantages of BitStamp

Fiat Trading

Bitstamp is a cryptocurrency exchange that allows users to buy and sell cryptocurrencies with fiat currencies. It supports USD, GBP, EUR, and Swiss Francs, making it a great option for beginners who are just getting started in the crypto world. It also offers a secure platform and low fees, making it a great choice for those looking to buy and sell cryptocurrencies. With its easy-to-use interface and wide range of fiat currencies, Bitstamp is a great choice for those looking to get started in the crypto world.

Payment Methods

Bitstamp makes it easy to get started with cryptocurrency trading, offering users the ability to fund their accounts with credit cards and bank transfers. This makes it simpler than ever to buy and sell digital currencies.

Security

Bitstamp is one of the most secure cryptocurrency exchanges on the market, with almost all of its funds kept in cold storage and fully insured. In 2015, Bitstamp was hacked and 19,000 Bitcoins were stolen, worth around 5 million USD. However, no customer funds were lost and the platform was completely rebuilt to prevent future hacks. The exchange has worked hard to ensure customer safety and security, and is now one of the most trusted exchanges in the industry.

Finally, it also offers its users two-factor authentication, text message alerts, and PGP encryption to keep user information private.

Fees

Bitstamp offers some of the lowest fees in the market, making it an ideal choice for new traders. Fees vary depending on the payment method and location, but are generally low and easy to understand.

Customer Service

Bitstamp is committed to providing excellent customer service, with a UK-based helpline for emergencies and a detailed FAQ page. They respond to user emails within three days, ensuring traders are kept happy and satisfied.

Reputation

Bitstamp is a reliable and professional crypto exchange, with links to financial institutions worldwide and full licensing. It has been audited by Ernst & Young, one of the Big Four accountancy firms.

Mobile App

Bitstamp’s mobile app has been highly rated by users, receiving an impressive 4.8 out of 5 stars on the Apple Store. This is a testament to the quality of the app, which provides users with a convenient and secure way to access their accounts.

Key Disadvantages of BitStamp

Coin Selection

Bitstamp is a popular cryptocurrency exchange that offers a limited selection of around 70 digital assets for trading. These include Bitcoin (BTC), Bitcoin Cash (BCH), Litecoin (LTC), Ethereum (ETH) and Ripple (XRP). While this selection is suitable for beginner traders, more experienced traders may prefer an exchange with a larger selection of trading pairs, such as Binance, which offers more than 1400.

User Friendliness

Bitstamp is a professional trading exchange that can be difficult for new users to understand. For those with no trading experience, Coinbase may be a better option as it is simpler and easier to use.

BitStamp Fees

Bitstamp is a cryptocurrency exchange with a competitive fee structure. Cryptocurrency deposits are free, while withdrawals incur a fixed network fee which differs per cryptocurrency. An exception to this is when customers withdraw bitcoin using BitGo Instant, which costs 0.1% of the amount being transferred, and when they withdraw Ripple IOUs, which costs 0.2% of the transferred amount. Bitstamp’s fees are cheap compared to many rivals, making it an attractive option for those looking to buy and sell cryptocurrencies.

| Currency/Withdrawal Fee | Bitstamp | Kraken | Bitfinex | Coinbase Pro |

| Bitcoin (BTC) | 0.0005 BTC | 0.0005 BTC | 0.0004 BTC | Free |

| Ethereum (ETH) | 0.001 ETH | 0.005 ETH | 0.00135 ETH | Free |

| Litecoin (LTC) | 0.001 LTC | 0.001 LTC | 0.001 LTC | Free |

| Ripple (XRP) | 0.02 XRP | 0.02 XRP | 0.1 XRP | Free |

| Bitcoin Cash (BCH) | 0.0001 BCH | 0.0001 BCH | 0.001 BCH | Free |

International wire transfers have a deposit fee of 0.05% (minimum of €7.50) and a withdrawal fee of 0.1% (minimum of €25). European customers making a SEPA bank transfer deposit funds to Bitstamp free of charge, while SEPA withdrawal costs €3.00. Bitstamp offers customers a secure and convenient way to buy and sell digital currencies with competitive fees. The platform is designed to make it easy to buy and sell cryptocurrencies with fiat currencies, with no hidden fees or charges. Customers can also benefit from the low fees associated with SEPA transfers, making it an attractive option for those looking to buy and sell digital currencies.

Any amount purchased directly with a bank card comes with a 5% fee on Bitstamp’s behalf, and may have additional fees charged by the card issuer. Bitstamp offers a secure platform for users to buy and sell digital currencies, with a range of features and tools to help them manage their investments.

It offers competitive trading fees, with a starting rate of 0.50% for users with a 30-day trading volume of less than $10,000. This rate is lower than many other exchanges, making Bitstamp an attractive option for traders.

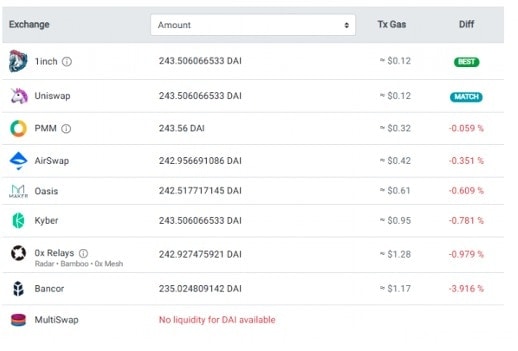

The minimum trade amount at Bitstamp is 25 EUR/USD or 0.001 for BTC-denominated pairs. Bitstamp charges a 0.50% fee for any trader whose 30-day volume is less than $10,000. Other exchanges like Kraken and Bitfinex tend to charge less per trade, with Kraken offering a 0.16% fee for market makers and 0.26% for takers, and Bitfinex charging 0.1% for market makers and 0.2% for takers. Bitstamp is a reliable and secure platform for traders looking to buy and sell digital assets.

It offers low-cost SEPA deposits and withdrawals, and discounts for high-volume traders. Although it is not the cheapest option out there, it is still a cost-effective choice for low-volume traders. The platform is secure and reliable, and offers a wide range of trading options. It is a great choice for European traders looking for a secure and cost-effective trading platform.

Is BitStamp a Wallet?

Bitstamp is an online platform for buying and selling cryptocurrencies, but it is not a wallet. Wallets are used to store and access cryptocurrency codes, and they can be either hot (online) or cold (offline). Bitstamp is not a wallet, but it does provide a secure platform for buying and selling cryptocurrencies. It also offers a range of features such as two-factor authentication, multi-signature accounts, and a variety of payment methods. Bitstamp is a reliable and secure platform for buying and selling cryptocurrencies, but it is not a wallet. To store and access your cryptocurrency codes, you will need to use a wallet.

It is important to never keep all your cryptocurrency online, and a combination of hot and cold storage is the best way to ensure your funds are secure. For added security, a hardware wallet such as the Ledger Nano X is recommended. This device is similar to a USB stick and provides an extra layer of protection for your crypto assets. With Bitstamp, users can rest assured that their funds are safe and secure.

Who Is Bitstamp Best For?

Bitstamp is a secure and reliable platform with millions of satisfied users. It offers a professional design and features that are ideal for experienced users, but may be confusing for beginners. The platform is easy to use and provides a safe and secure environment for users to buy, sell, and trade digital currencies. It also offers a variety of features, such as low fees, fast transactions, and a wide range of payment options. Bitstamp is a great choice for those looking for a reliable and secure platform to buy, sell, and trade digital currencies.

This exchange is a great choice for beginner crypto traders who want to get started quickly and easily. The exchange offers fiat trading and credit card purchases, making it easy to get started. Bitstamp is a perfect choice for users who don’t want to wait to start trading. The exchange also offers a range of features and tools to help users make informed decisions.

Conclusion

Bitstamp is a trusted crypto exchange, renowned for its security and customer-focused team. With a user-friendly interface, it’s becoming one of the world’s most popular crypto exchanges. If you’re looking for a secure and reliable platform to trade cryptocurrencies, Bitstamp could be the perfect choice for you.

Sign up here to get started today!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.