The increasing popularity and adoption of cryptocurrency has expanded the wallet market. Now that many well-known traditional and crypto brands accept crypto as a payment option, enthusiasts are constantly on the lookout for safer ways to store their digital assets.

Ledger is one of the most popular hardware crypto wallets in the sector. Since releasing the Nano S in 2016, Ledger has become a household name in the cryptocurrency space. To date, Ledger has launched three models of hardware crypto wallets, the Nano S, Nano X, and most recently, the Nano S Plus. The Ledger Nano S Plus retails for USD$79.

CLICK BELOW TO BUY!

Check out our previous Ledger reviews here:

Ledger Nano X review

Ledger Nano S review

What is the Ledger Nano S Plus?

The Nano S Plus is Ledger’s third release from its Nano series, a line of pocket-sized hardware crypto wallets. Ledger’s Nano S Plus has all of the features of the original Nano S but with a few upgrades, including support for NFT storage and management. Additionally, the Nano S Plus has built-in support for interacting with various DeFi (decentralized finance) apps and services. (thetelegramnews.com) The wallet is an effective option for people looking to manage crypto, NFTs, and other decentralized services in one place.

New features of the Ledger Nano S Plus

Ledger introduced the Nano S Plus with an exciting list of features and improvements over the two previous releases. Some of the major new features on the Nano S Plus include:

- Bigger display. Same display size of the Nano X but on a smaller device!

- Expanded cryptoasset support. The Nano S Plus doesn’t just hold cryptocurrencies, but also NFTs and is the first Ledger device to have DeFi app integration.

- Industry-leading security. The Nano S Plus uses the same industry-leading security with CC EAL5+ certification.

- Easy setup. USB plug-and-play feature means owners can begin using the device in minutes.

- Low cost. The Nano S Plus comes at an affordable price of US$79, making it an attractive option for all levels of crypto traders.

Security features: is the Nano S Plus safe?

The Nano S Plus uses the same certified secure chip (CC EAL5+ chips) as the Nano X to protect users’ assets. This chip employs state-of-the-art technology that guarantees high-level security and asset protection against phishing and other asset extraction schemes. Additionally, the wallet has industry-standard security features, including a security phrase, PIN code locks, transaction confirmations, password encryption, and more.

To learn more about the security features of the Nano S Plus and Nano X, click here.

5/5 Security Rating

Cryptoasset support

A major Nano S Plus feature is the huge roster of supported crypto assets and apps. The Nano S Plus supports over 5,500 assets and can accommodate up to 100 different apps. Some supported assets include:

- Bitcoin (BTC)

- Ethereum (ETH)

- ERC-20 tokens

- Dogecoin (DOGE)

- XRP

- BNB

- Cardano (ADA)

- Polygon (MATIC)

- Litecoin (LTC)

- Tron (TRX)

The Nano S Plus has 1.5MB of storage and with that can run over 100 apps simultaneously. On Ledger devices, an “app” refers to the app required to be installed to access a cryptocurrency on the device e.g. in order to access your BTC on the device you need to install the app on the Ledger first. Meaning that, unlike the Nano S which can only run 3 apps simultaneously, users are not required to delete apps in order to access other cryptocurrencies which do not have the apps already installed.

But what is truly unique about the Nano S Plus is that it is the first Ledger device to offer NFT support. Users of the Nano S Plus can securely hold, send, and receive NFTs via the Ledger Live app. Ledger has made this process user-friendly, as owners can authenticate transactions right from the wallet’s interface.

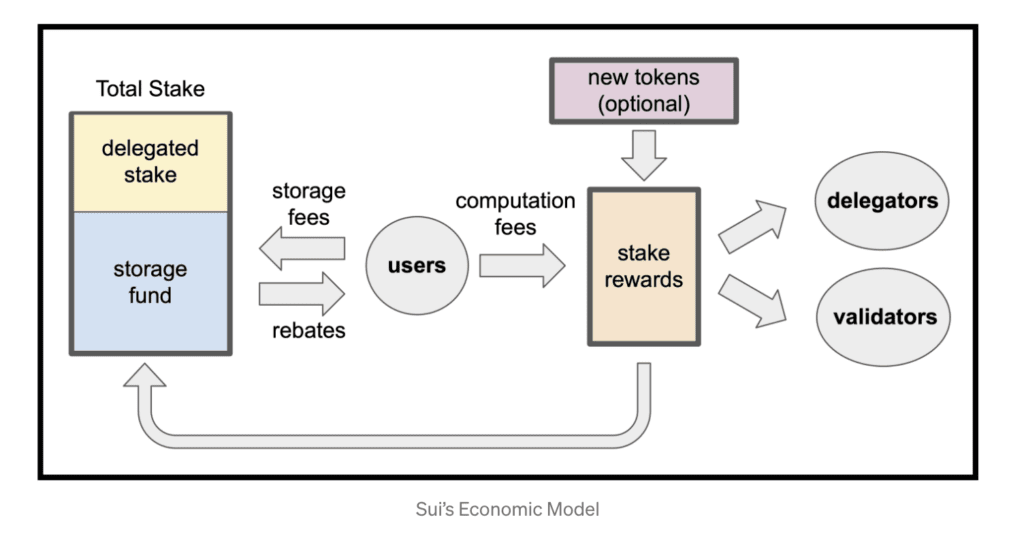

Users of the Nano S Plus can also access several DeFi applications through the Ledger Live user interface. Anyone can securely buy, exchange, lend or stake crypto assets.

The NFT support and DeFi app access give the Nano S Plus an even bigger boost in features compared to the Nano S and for that reason, we rank this category even higher than the Nano X.

4.8/5 cryptoasset support

Hardware design

Similar to the Nano S, the Nano S Plus also has two hardware buttons located on the top of the device.

The Nano S Plus has a much larger screen than its predecessor, which makes usage very easy. Same as the Nano X, the 128 x 64-pixel screen makes operating the device simple and helps users navigate the product’s features. The main benefit of the larger screen is that users can see the entire wallet address clearly displayed as one line on the screen. The screen also blends well into the rest of the device, adding to the Nano S Plus’ aesthetic appeal. And whilst the screen size on the Nano S Plus is the same as the Nano X, the Nano S Plus is a much smaller device overall.

The Ledger Nano S Plus’ measurements are smaller than the Nano X at 62.39 x 17.40 x 8.24 mm, and weighs in at only 21g. The wallet is about the size and weight of an average USB flash drive and is easy to carry around.

4.5/5 for hardware design

4.5/5 for ease of use

What’s in the Ledger Nano S Plus Box?

The Nano S Plus wallet comes with the following inside the box:

- The Ledger Nano S Plus hardware

- A Type-C USB cable to connect the Ledger to a computer

- An orange box with three notepads for the Secret Recovery Phrase

- A purple box with the manual instructions

- A key-holder chain with a Ledger logo

Final Verdict

The Ledger Nano S Plus is a great option for enthusiasts looking for a secure, reliable, and easy-to-use hardware wallet. It offers the same features as the original Ledger Nano S and adds a lot more. Furthermore, users looking to upgrade from the older Ledger Nano S can quickly move their assets to the newer S Plus.

The Ledger Nano S Plus is one of the best hardware wallet options on the market for crypto and NFT enthusiasts who currently own or plan to purchase NFTs or get involved with any DeFi project.

The Ledger Nano S Plus retails for US$79.

Ledger Nano S Plus worth it?

[wp-compear id=”5154″]

Product Specifications (Technical Specifications)

Ledger Nano S Plus Product Specifications:

| Processors | |

| Compatibility | 64-bits desktop computer (Windows 8+, macOS 10.8+, Linux) excluding ARM Processors.Also compatible with smartphones Android 7+. |

| Connector | USB-C |

| Security Certification | CC EAL5+ |

| Size | Size: 62.39mm x 17.40mm x 8.24 mm Weight: 21g |

| Supported assets | 5,550+ digital assets plus NFTs and DeFi app access |